Yes! You can use AI to fill out Form 1040-X, Amended U.S. Individual Income Tax Return

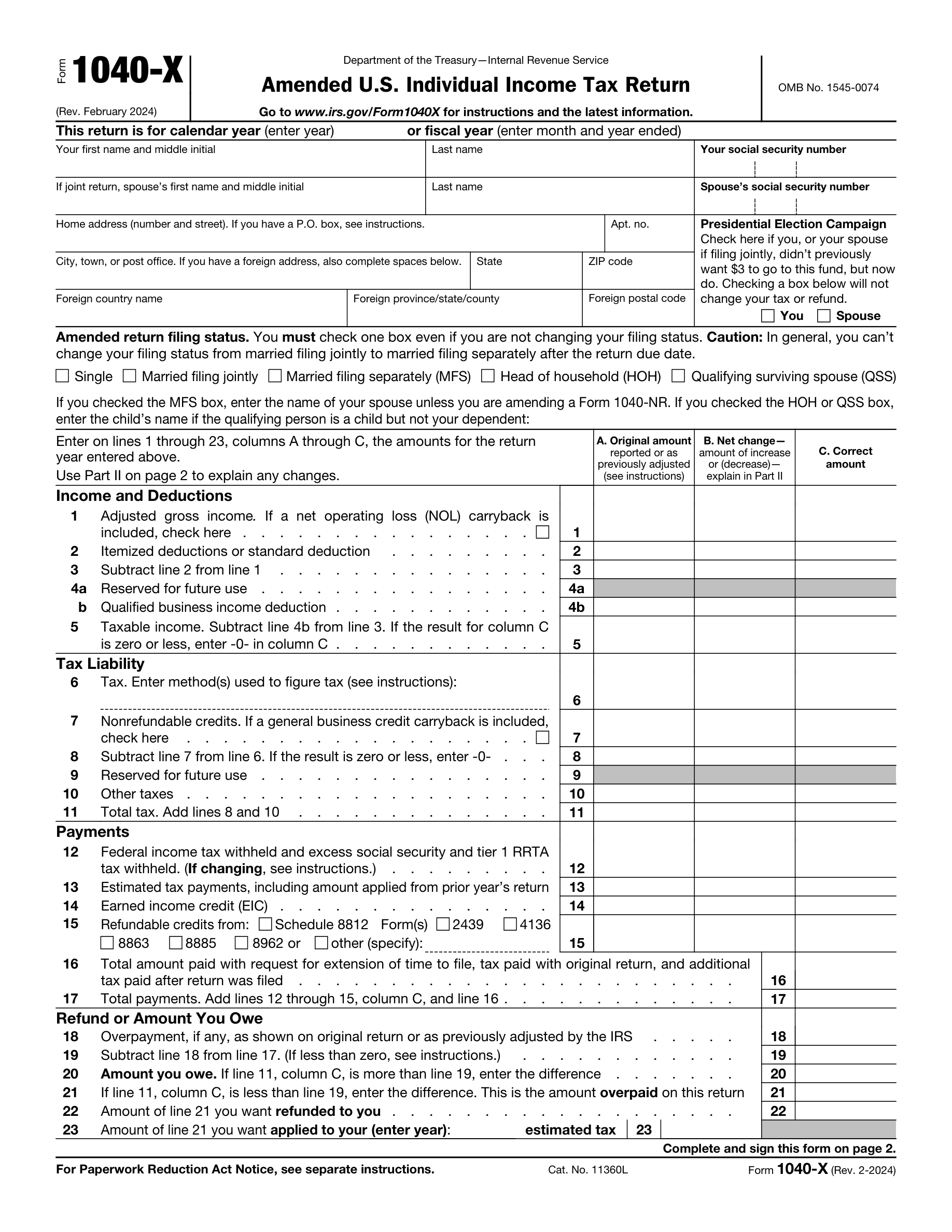

Form 1040-X, Amended U.S. Individual Income Tax Return, is used by taxpayers to correct errors on their previously filed tax returns. It is important to fill out this form to ensure that your tax records are accurate and to claim any additional refunds or credits you may be entitled to.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 1040-X using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 1040-X, Amended U.S. Individual Income Tax Return |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 145 |

| Number of pages: | 2 |

| Version: | 2024 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-1040x |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/f1040x.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 1040-X Online for Free in 2025

Are you looking to fill out a 1040-X form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your 1040-X form in just 37 seconds or less.

Follow these steps to fill out your 1040-X form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 1040-X.

- 2 Enter your personal information and tax year.

- 3 Fill in the original amounts and changes.

- 4 Complete the explanation of changes section.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 1040-X Form?

Speed

Complete your Form 1040-X in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 1040-X form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 1040-X

Form 1040-X, Amended U.S. Individual Income Tax Return, is used to correct or make changes to a previously submitted U.S. Individual Income Tax Return (Form 1040). This form is essential for individuals who need to report additional income, correct errors, or make adjustments to deductions and credits.

Any individual who needs to make corrections or changes to their previously filed tax return should file Form 1040-X. This includes reporting additional income, correcting errors, or making adjustments to deductions and credits.

Form 1040-X requires the taxpayer's personal information, including name, social security number, and address. It also requires information about any changes to income, deductions, and tax payments. Be sure to include the tax year of the original return and the reason for filing the amended return.

Yes, you can change your filing status on Form 1040-X. However, be aware that there are certain restrictions and limitations. For example, if you are married filing jointly and later become single, you may need to file two separate amended returns. It is essential to consult the instructions for Form 1040-X and consult with a tax professional for guidance.

To calculate the net change in income and deductions on Form 1040-X, subtract the corrected amount from the original amount reported on your tax return. For example, if you reported $10,000 in income initially but later discovered that you should have reported $12,000, the net change would be $2,000. Similarly, if you need to adjust a deduction, subtract the corrected amount from the originally reported amount.

Part II on Form 1040-X is used to explain any changes made on the form and to provide supporting documentation for those changes.

Yes, you may need to attach supporting documents and new or changed forms and schedules to Form 1040-X to explain the changes you are making.

The deadline for filing Form 1040-X depends on the reason for the amendment and the type of taxpayer. Generally, it must be filed within three years from the date the original return was due or within two years from the date the tax was paid, whichever is later.

Yes, you can e-file Form 1040-X using certain tax software or through the IRS's Free File program. However, not all taxpayers are eligible to e-file.

If you fail to file Form 1040-X on time, you may be subject to penalties and interest on any unpaid taxes. The amount of the penalty depends on the reason for the late filing and the amount of the unpaid tax.

Yes, both the taxpayer and their spouse (if filing jointly) must sign Form 1040-X and provide their occupation and phone number.

The Identity Protection PIN is used to help protect against identity theft and ensure that only the taxpayer or their authorized representative can file the amended return. It is important to note that the IRS will not ask for the Identity Protection PIN over the phone or by email, so be cautious of potential scams.

Yes, you can claim dependents on Form 1040-X by completing Part I and Part II of the form and providing the necessary information for each dependent, including their name, Social Security number, and relationship to the taxpayer.

A tax preparer can help you file Form 1040-X by preparing and signing the form on your behalf. They must provide their name, signature, date, and PTIN (Preparer Tax Identification Number) in the appropriate places on the form. It is important to note that the taxpayer is ultimately responsible for the accuracy of the information on the form.

Form 1040-X can be filed electronically using IRS e-file or by mailing a paper copy to the IRS. If filing electronically, you will need to use tax software that supports Form 1040-X. If mailing a paper copy, you should mail it to the address listed on the instructions for the form.

The deadline for filing Form 1040-X depends on the reason for filing the amended return. If you are filing to claim a refund, the deadline is generally three years from the original due date of the return or two years from the date the tax was paid, whichever is later. If you are filing to correct an error or make a change that results in an additional tax liability, there is no time limit for filing the amended return.

Compliance Form 1040-X

Validation Checks by Instafill.ai

1

Ensures the correct version of Form 1040-X for the tax year being amended is used

The software ensures that the version of Form 1040-X corresponds with the tax year that the user intends to amend. It checks the form's revision date against the tax year in question to prevent the submission of an outdated or incorrect form. This is crucial as tax laws and forms can change from year to year, and using the wrong version may lead to processing delays or the need to resubmit the form.

2

Verifies that the calendar year or fiscal year is accurately entered in the Header Section

The software verifies that the calendar or fiscal year is accurately entered in the Header Section of Form 1040-X. It cross-references the tax year with the user's provided information to ensure consistency throughout the document. This validation is important to avoid confusion and to ensure that the IRS processes the amendment for the correct tax year.

3

Confirms that the taxpayer's personal information is complete, including first name, middle initial, last name, and SSN

The software confirms that the taxpayer's personal information is complete and accurately filled out on Form 1040-X. It checks for the presence of the taxpayer's first name, middle initial, last name, and Social Security Number (SSN), and validates the format of the SSN. This step is essential to ensure the IRS can correctly identify the taxpayer and associate the amended return with the correct tax records.

4

Checks if the spouse's information is provided and accurate when filing a joint return

When a joint return is being amended, the software checks if the spouse's information is provided and accurate on Form 1040-X. It validates the spouse's first name, middle initial, last name, and SSN, ensuring that both sets of personal information match the IRS's records. This is particularly important for joint returns to ensure that the amendment reflects the correct information for both spouses.

5

Validates the completeness and correctness of the home address, including apartment number if applicable

The software validates the completeness and correctness of the home address provided on Form 1040-X. It ensures that the street address, city, state, ZIP code, and apartment number, if applicable, are all present and formatted correctly. Accurate address information is vital for correspondence regarding the amended return and for the proper delivery of any notices or refunds.

6

Foreign Address Validation

Ensures that if a foreign address is provided, it is complete with the correct country name, province/state/county, and postal code. The software checks for the presence of all required fields and verifies the format is consistent with standard international addressing formats. It also prompts the user to correct any missing or incomplete information to ensure the foreign address is properly recorded.

7

Presidential Election Campaign Fund Contribution Check

Confirms whether the taxpayer has elected to contribute to the Presidential Election Campaign fund. The software checks the appropriate box to indicate the taxpayer's decision and ensures that the selection or non-selection is clearly recorded. It also verifies that no contribution amount is required and that the taxpayer's choice does not affect their tax liability or refund.

8

Amended Return Filing Status Consistency Check

Verifies that the amended return filing status is consistent with the original return. The software ensures that changes to the filing status are permissible and notes that 'married filing jointly' cannot be changed to 'married filing separately' after the due date. It alerts the user if an attempt is made to make an impermissible change and provides guidance on allowable modifications to the filing status.

9

Income and Deductions Accuracy Check

Checks the accuracy of the original amounts, net changes, and corrected amounts for income and deductions on the amended return. The software compares the figures entered with the original tax return data, if available, and calculates the net changes to ensure they are accurate. It also prompts the user to review any discrepancies and make necessary corrections before submission.

10

Tax Liability and Credits Validation

Calculates and validates the tax liability, nonrefundable credits, and total tax to ensure the figures are correct. The software uses the latest tax tables and applicable laws to compute the tax liability accurately. It also checks for proper application of nonrefundable credits and ensures that the total tax amount is consistent with the corrected income and deductions.

11

Reviews the payments section for accurate reporting of federal income tax withheld, estimated tax payments, and other credits

The AI meticulously reviews the payments section to ensure that all federal income tax withholdings, estimated tax payments, and applicable credits are reported accurately. It cross-references the amounts listed with supporting documentation to confirm their validity. The AI also checks for any discrepancies between the reported amounts and the taxpayer's records. This validation is crucial for maintaining the integrity of the tax return and avoiding potential issues with the IRS.

12

Determines the correct overpayment or amount owed after amendments and validates taxpayer's decision on handling overpayment

The AI calculates the correct overpayment or amount owed after taking into account all amendments to the tax return. It ensures that the taxpayer's decision regarding the handling of any overpayment is consistent with IRS rules and regulations. The AI also verifies that the taxpayer has provided clear instructions for either a refund or application of the overpayment to future taxes. This validation is essential for the proper settlement of the taxpayer's account.

13

If dependents information is changed, ensures that Part I is completed with original and corrected number of dependents

In cases where there is a change in the information regarding dependents, the AI ensures that Part I of the form is accurately completed with both the original and the corrected number of dependents. It verifies that all necessary adjustments are made to reflect the updated dependent information. The AI also checks for consistency across all sections of the tax return that may be affected by the change in dependent status. This validation is important for the accuracy of exemptions and credits related to dependents.

14

Examines the Explanation of Changes (Part II) for a detailed explanation and supporting documentation for each change made

The AI examines Part II of the form, which is the Explanation of Changes, to ensure that there is a detailed explanation for each amendment made to the tax return. It confirms that the taxpayer has provided adequate supporting documentation for the changes. The AI also checks for clarity and completeness of the explanations to prevent any misunderstandings or queries from the IRS. This validation is vital for substantiating the amendments made to the tax return.

15

Confirms that the form is signed and dated by the taxpayer(s) and includes occupation, phone number, and Identity Protection PIN if applicable

The AI confirms that the Amended U.S. Individual Income Tax Return form is properly signed and dated by the taxpayer(s). It ensures that the taxpayer's occupation, phone number, and Identity Protection PIN (if applicable) are included on the form. The AI also verifies the authenticity of the signature and checks that the date of signing is within a reasonable time frame of the form's submission. This validation is critical for the form's legal and procedural compliance.

16

Preparer's Information Completeness

Ensures that if a paid preparer is involved, their information is thoroughly completed on the Amended U.S. Individual Income Tax Return. This includes verifying the presence of the preparer's signature and the date of signing. Additionally, the Preparer Tax Identification Number (PTIN) must be included, along with the firm's information if the preparer is self-employed. The software cross-references this data with the IRS database for PTIN validity when applicable.

17

Attachment of Supporting Documents

Verifies that all necessary supporting documents are attached to the Form 1040-X. This includes checking for any new or changed forms and schedules that are relevant to the amendment. The software scans for indications of changes in the taxpayer's income, deductions, credits, or tax liability and prompts for the corresponding documentation to ensure completeness and compliance with IRS requirements.

18

Entries and Calculations Accuracy

Performs a final review of all entries and calculations on the Amended U.S. Individual Income Tax Return to ensure accuracy. The software utilizes built-in algorithms to cross-verify the arithmetic consistency of the tax return, flagging any discrepancies or unusual figures that may indicate an error. It also compares current entries to prior submissions, if available, to detect significant deviations.

19

Record Keeping Confirmation

Confirms that a copy of the amended return and all attachments are kept for the taxpayer's records. The software prompts the user to save and archive a digital copy of the completed Form 1040-X and any accompanying documentation. It also provides options for printing and secure storage recommendations, ensuring that the taxpayer maintains a comprehensive record of their filing.

20

Correct Mailing Address

Checks that the completed Form 1040-X is mailed to the appropriate IRS address as specified in the instructions. The software references the latest IRS guidelines to determine the correct mailing address based on the taxpayer's location and the specific details of their amendment. It then provides the user with the correct address and, if available, options for certified or electronic delivery.

Common Mistakes in Completing Form 1040-X

Filing an Amended U.S. Individual Income Tax Return with the incorrect form version for the tax year can lead to processing delays and potential errors in the amendment. Taxpayers should ensure they are using the correct version of the form that corresponds to the tax year they are amending. The IRS updates tax forms annually, so it is crucial to download the form from the IRS website or obtain it through a professional tax preparer for the specific year being amended. Always double-check the form's year in the top right corner before beginning the amendment process.

The Social Security Number (SSN) is a critical identifier on tax forms, and omitting it or using an incorrect SSN can result in the rejection of the amended return. Taxpayers must carefully enter their SSN and, if applicable, their spouse's SSN in the designated fields. It is advisable to double-check the numbers against the Social Security card to prevent transposition errors. If a taxpayer has recently changed their SSN, they should ensure that the new number is used on the form. Keeping personal information secure but accessible when preparing tax documents can help avoid this mistake.

When amending a joint tax return, it is essential to include the spouse's information. Neglecting to provide complete and accurate details for both spouses can lead to processing issues and may affect the accuracy of the amended return. Taxpayers should review the original joint return to ensure that all information matches and is up to date. If there have been changes to the spouse's information since the original filing, such as a name change or a new SSN, these changes must be reflected on the amended return. Both spouses are also required to sign the amended return before submission.

Providing an incorrect or incomplete address on the Amended U.S. Individual Income Tax Return can cause significant delays in processing and may result in the taxpayer not receiving important correspondence from the IRS. Taxpayers should verify their address details carefully, including apartment or suite numbers, city, state, and ZIP code. For those with a foreign address, it is important to follow the IRS guidelines for entering the address in the format required. Reviewing and updating personal information before filing can prevent this common error. Using a current utility bill or official document as a reference can help ensure accuracy.

The Presidential Election Campaign box is an often-overlooked section of the tax return, but it is important to indicate your preference regarding this campaign fund. Failing to check the box does not increase tax liability or reduce the refund amount; it simply directs $3 of your tax payment to the Presidential Election Campaign Fund. Taxpayers should take a moment to consider their preference and check the box if they choose to contribute. This decision will not affect the taxpayer's refund or balance due. Reading all sections of the tax form carefully can ensure that no parts are inadvertently skipped.

Taxpayers often select an incorrect filing status when amending their tax returns. This can lead to discrepancies in tax calculations and liabilities. To avoid this mistake, carefully review the filing status that was used on the original tax return and ensure that any changes to the filing status for the amended return are permitted under IRS rules. Consult the IRS instructions for the form or a tax professional if there is any uncertainty about which status to select.

Once the due date for filing a tax return has passed, taxpayers are generally not allowed to change their filing status from 'married filing jointly' to 'married filing separately' for that year. It is crucial to make the correct filing status decision before the deadline. If considering amending to a separate filing status, be aware of the deadline and consult the IRS guidelines or a tax advisor to understand the implications and rules regarding such a change.

When completing an amended return, it is essential to accurately report the original amounts from the initial filing, as well as the net changes and corrected amounts. Errors in these figures can result in processing delays or incorrect tax assessments. Double-check all entries against the original tax return and any supporting documentation. If adjustments are made, clearly explain the reason for each change and how the corrected amount was determined.

Calculating tax liability or credits incorrectly on an amended return can lead to either an overpayment or underpayment of taxes. Use the appropriate tax tables, schedules, and instructions to ensure accurate calculations. Consider using tax preparation software or consulting with a tax professional to help with complex calculations. Always review the entire amended return before submission to catch any potential errors in the calculations.

Taxpayers sometimes inaccurately report the amount of federal income tax withheld or estimated tax payments on their amended returns. This can affect the refund or balance due. To prevent this, verify the amounts with your W-2, 1099, or other tax documents that show federal tax withholding. For estimated payments, refer to bank statements or check copies. Keep a detailed record of all tax payments made throughout the year to ensure accurate reporting on the amended return.

Miscalculations of refunds or amounts owed can occur when taxpayers amend their returns, leading to incorrect payment or refund claims. To avoid this, double-check all the changes that affect your tax calculations, including income adjustments, credits, and deductions. Use tax software or consult with a tax professional if necessary to ensure accuracy. Review the IRS instructions for the specific lines that are being amended to understand how the changes impact your tax liability.

Failing to update dependent information can result in the rejection of exemptions and credits that are tied to dependents. Ensure that all dependent information is current and accurate, including names, Social Security numbers, and their relationship to you. If there have been any changes, such as a dependent no longer qualifying due to age or income, update this information accordingly. Cross-reference with the original tax return to confirm that all changes are consistent and justified.

Providing an incomplete or unclear explanation of the changes made on an amended return can lead to processing delays or questions from the IRS. It is important to clearly explain the reason for each amendment in the designated area of the form. Be specific and concise, and attach any supporting documents or schedules that are necessary to substantiate the changes. Review the explanation before submitting to ensure it is understandable and complete.

An unsigned amended return is like an unsigned check – it's not valid. The IRS requires a signature to process the form. Before submitting the amended return, verify that you have signed and dated it. If filing jointly, both spouses must sign. Keep a copy of the signed form for your records. Check the final review before mailing to ensure that this crucial step is not overlooked.

When filing a joint amended return, it is mandatory for both spouses to sign the form. Neglecting to have both signatures can result in the return being considered invalid. Ensure that both parties review the amendments and understand the changes before signing. Set a reminder or a checklist for both spouses to sign if the tax return is not being filed immediately after completion. Verify that both signatures are present before sending the form to the IRS.

Taxpayers often overlook the fields for occupation and phone number on the Amended U.S. Individual Income Tax Return form. It is crucial to provide complete personal information, as it can be used for identification purposes and to facilitate communication with the IRS. To avoid this mistake, review the form carefully before submission and ensure that all personal details, including occupation and phone number, are filled in accurately. Double-checking the form against previous tax returns can help ensure consistency and completeness of information.

An Identity Protection Personal Identification Number (IP PIN) is provided by the IRS to protect taxpayers against tax-related identity theft. If you have been issued an IP PIN, it must be included on your tax return. Neglecting to include the IP PIN can lead to processing delays and may trigger additional security checks. Taxpayers should keep their IP PIN confidential and ensure it is entered correctly on the tax form. If you have an IP PIN, always remember to include it on your amended return to avoid complications with the IRS.

When a paid preparer completes the Amended U.S. Individual Income Tax Return, they must provide all required information, including their Preparer Tax Identification Number (PTIN), name, and address. Incomplete preparer information can lead to processing delays and potential penalties for the preparer. Taxpayers should verify that their preparer has completed all necessary fields before the form is submitted. It is the taxpayer's responsibility to ensure that the tax preparer they choose is compliant with IRS requirements.

Self-employed tax preparers must check the box indicating their self-employed status on the tax return they prepare. This is a commonly missed step that can affect the accuracy of the return. To prevent this oversight, self-employed preparers should have a checklist of all required actions when completing a client's return. Taxpayers should confirm that their preparer has checked this box if applicable, as it is part of the preparer's due diligence and affects the return's validity.

When amending a tax return, it is essential to attach any new or revised forms and schedules that support the changes made. Failure to attach these documents can result in the IRS being unable to process the amendment, leading to delays or the amendment being considered incomplete. Taxpayers should carefully review their amended return to ensure that all necessary documentation is attached before mailing it to the IRS. Using a checklist of changes made and corresponding forms needed can help ensure that nothing is overlooked.

Filing an Amended U.S. Individual Income Tax Return requires careful attention to detail. Taxpayers often submit the form with errors in entries and calculations, which can lead to processing delays or incorrect tax assessments. To avoid this, double-check all information for accuracy before submission. Ensure that all numerical entries are correct and that the calculations comply with the current tax laws and regulations. It is advisable to use tax software or consult tax tables to verify figures.

Many taxpayers forget to retain a copy of their Amended U.S. Individual Income Tax Return and any supporting documents. This oversight can create complications if questions arise later or if the IRS requests additional information. To prevent this, make a complete copy of the amended return and all attachments for your records before mailing. Store these copies in a safe and accessible place. Keeping a digital copy as a backup is also a prudent practice.

The IRS has specific addresses for mailing amended returns, which vary depending on the taxpayer's location and whether a payment is included. Sending the form to the incorrect address can result in delays or misplacement of the return. To ensure proper delivery, verify the correct mailing address for your situation on the IRS website or in the form's instructions. Additionally, consider using certified mail or another tracking service to confirm receipt by the IRS.

Amending a tax return can be complex, and errors can have significant consequences. Taxpayers often attempt to complete the form without seeking help when they are uncertain about the process. To avoid mistakes, consult a tax professional if you have doubts about how to properly amend your return. A qualified tax advisor can provide guidance on the amendment process and help ensure that the return complies with tax laws. This can be especially important for complex tax situations or when multiple years are involved.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 1040-X with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 1040-x forms, ensuring each field is accurate.